Connective broker resources

Find out the latest news and information from Connective

APRA Update – Living Expenses

November 27th, 2017

APRA Update – Living Expenses

In a presentation at the Australian Securitisation Forum on November 21, APRA Chairman Wayne Byres called on the finance industry to recognise that there are “a number of factors that are contributing to an environment of heightened risk” for both consumers and the industry at present. Of most concern to APRA is the fact that Australia’s overall housing debt-to-income ratio is nearing 200%, which is a record high.

According to APRA, about 10% of new home loans taken out in Australia were equal to more than six times the customer’s income. Based on these calculations, in the event that interest rates should rise to 7% p.a. in the future, this would result in over 50% of an average borrower’s net income being spent solely on servicing their home loan.

According to CoreLogic, in Sydney, borrowers are already spending, on average, 48.4% of their gross annual income on servicing their mortgage, even with interest rates at their current low levels. The national figure is currently around 37.2%. Considering interest rates will rise at some stage, the risk of increasing levels of mortgage stress is a genuine concern that must be considered.

More focus on ‘responsible lending’ is required.

Moving forward, APRA – and therefore our lender partners – will be paying more attention to borrowers with a low net income surplus, as these are the consumers who will be most vulnerable to ‘shocks’ such as interest rate rises.

Mr Byrne said “From APRA’s perspective, we would like to see the industry devote more effort to the collection of realistic living expense estimates from borrowers…” So once again, mortgage brokers will be on the front-line when putting these policies into practice.

Are you being ‘responsible’?

From a legal stand-point, responsible lending is not about credit risk assessment – meaning it has nothing to do with the financier’s assessment of risk of loss. (That is up to the lenders to manage with their credit policies.) From our perspective, it’s about whether the consumer can repay the loan without “substantial hardship” and that the loan will meet the consumer’s requirements and objectives.

The legal requirements are well known and easily stated. A licensee (and its credit representatives) must make:

- reasonable inquiries into the consumer’s financial situation,

- reasonable inquiries into the consumer’s requirements and objectives, and

- reasonable steps to verify the consumer’s financial situation.

A licensee (and its credit representatives) must then make sure that the loan is not ‘unsuitable’. A loan will be unsuitable if it does not satisfy two equally important tests:

Test 1: The borrower will be unable to repay or will only be able to repay with substantial hardship. If the borrower can only repay by selling the borrower’s principal place of residence, it is presumed that the loan will cause substantial hardship unless the contrary is proved. This presumption relates only to the borrower’s principal place of residence. This presumption will not apply if the borrower has to sell other assets, for example an investment property. This presumption can be rebutted, for example by demonstrating that sale of the home at or before the time the loan is repayable meets the borrower’s requirements and objectives.

Test 2: The loan meets the borrower’s requirements and objectives.

This brings us to two essential areas of consideration:

- What inquiries do licensees (and their credit representatives) have to make? What’s required in the Fact Find/Needs Analysis?

- How much verification is required? What supporting documentation should be obtained and/or what exact steps need to be taken to verify the client’s financial situation?

In terms of meeting your responsible lending obligations, this is where your analysis of a customer’s actual living expenses is vital – and that comes down to studying their banking transaction statements. Some lenders have already changed their credit policies so that loan applications will only be approved if they pass a stringent loan-to-income ratio test, and when submitting your application, these must be considered too. You can access these in Mercury or at news.connective.com.au.

Your Compliance Team’s recommendations.

Here are our recommendations to assist when enquiring and verifying a client’s declared monthly living expenses:

- Undertake reasonable steps for verification of the information provided by the client.

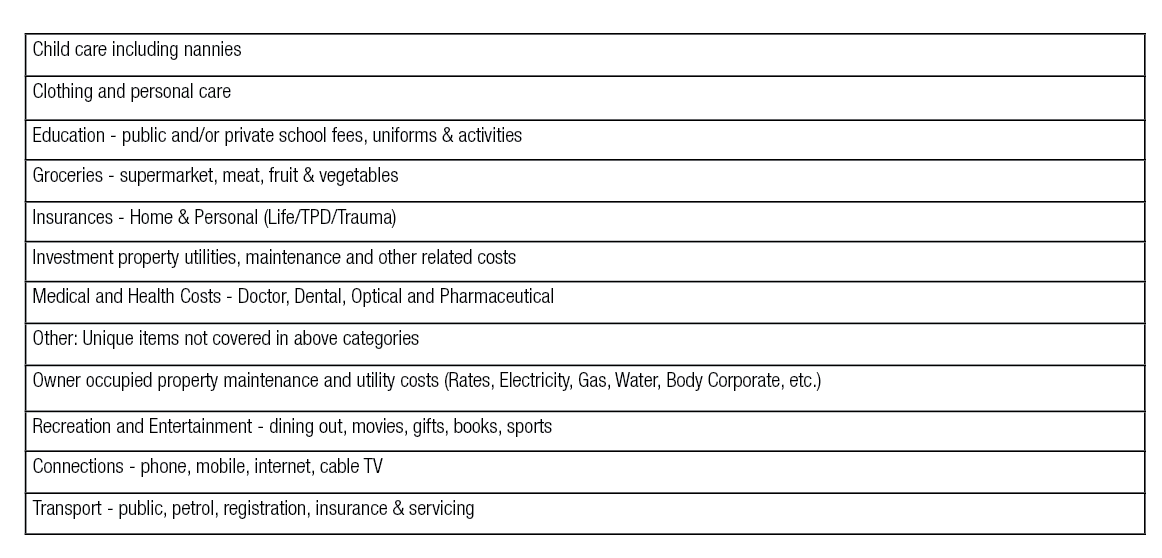

- Complete the ‘Needs Analysis’ questionnaire within Mercury – obtaining the clients identified and declared monthly living expenses for each expense category as follows:

- Assist each client to fully understand their current (and future) financial situation and be sure to make an accurate assessment of their monthly living expenses.

- Record a file note declaring that a discussion took place about inquiring and verifying the client’s current financial situation, in particular confirming their monthly declared living expenses.

- Obtain (mandatory requirement for Connective Credit Reps) the latest 3 months of ‘bank transactional statements’ as evidence you have reviewed and considered the true cost of their monthly living expenses.

Any questions?

For more information about how to estimate a client’s living expenses, check out our recent article here or visit Connective Wiki. If you have any questions or need some help, the Compliance Team will be happy to assist. Get in touch by clicking your help icon in Mercury, or email us at compliance@connective.com.au

Sources: The Adviser MPA Magazine CoreLogic Reports Mortgage Credit Risk