Connective broker resources

Find out the latest news and information from Connective

Rid yourself of pesky, inefficient spreadsheets!

December 4th, 2017

By Aaron Cody, Broker Support Manager

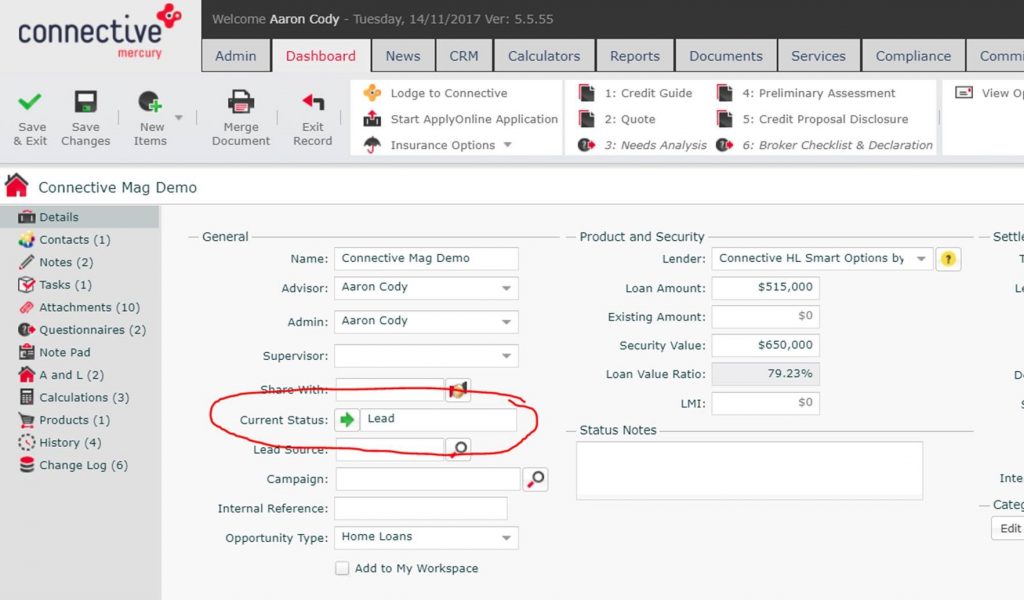

Are you one of the many brokers who still spend precious hours maintaining a spreadsheet to track your loans in progress? There’s a better way! Mercury provides up to date information on the progress of all of your loans. How? Mercury uses the Current Status field in an Opportunity:

By spending a few seconds to move a loan from one status to the next, you can track exactly where your pipeline is at from the main CRM tab. As an added bonus, this action can also trigger automated emails and tasks! Check out Auto Actions in Connective Wiki to find out more, or contact your Broker Support Manager if you want some help to set these processes up to maximise efficiency.

View your loan’s progress in Mercury

Mercury lets you see where each loan sits in your pipeline and how many days it’s been sitting in that status. This is a great way to make sure loans aren’t lingering. By monitoring the time a loan spends in each stage of your workflow, you can also identify bottlenecks.

Armed with this information, you can set about redesigning or developing processes to help overcome these bottlenecks. It won’t take you very long to create a more efficient service, as well as help build more consistency into your service delivery. Continual improvement is what separates a high performing business from an average performing business and consistency of delivery is absolutely fundamental to your business success.

Throw away your spreadsheets now!

So, ‘how do I replace those spreadsheets?’ I hear you ask! By keeping on top of the loan status, the information you can derive from the main CRM screen becomes quite rich. You’ll soon find that it gives you all the information you’ve been maintaining a spreadsheet to track.

You’ll find this is especially useful in your weekly staff briefing (if you have staff), as you can update loan statuses on the fly to ensure the data is relevant and accurate. This data will also inform your Business Statistics report which will take the value of following this process to the next level.

Want to report back to a referral source on the outcomes of the clients they have sent you in the past financial year? Simple! The Business Statistics report can easily do this and a whole lot more. Find out more about using the Reporting Tab in Mercury on Connective Wiki here.

So I challenge you, spreadsheets be gone! Let Mercury do the heavy lifting for you when developing your business reporting.